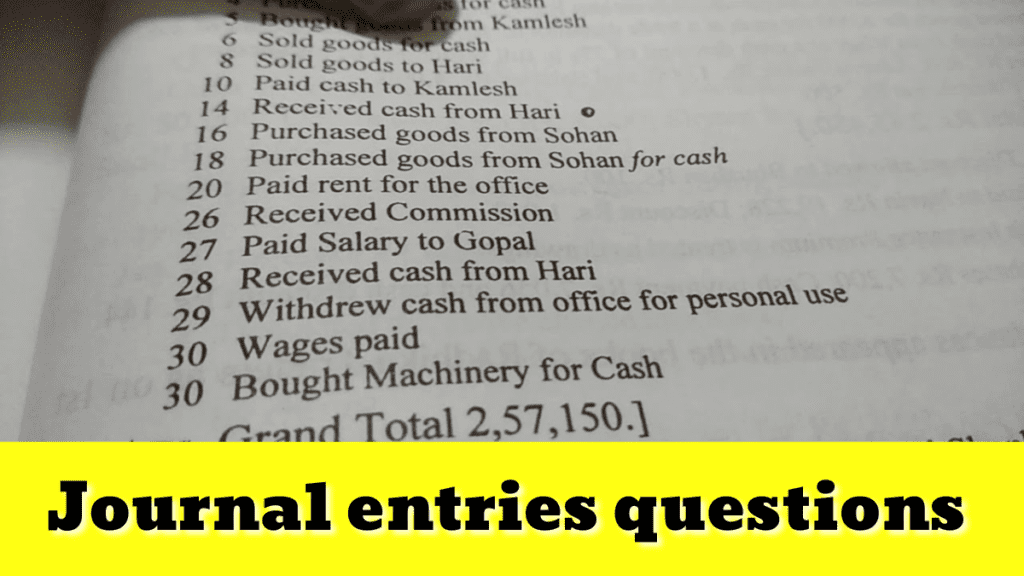

journal entries questions with solutions pdf

Here are 10 more journal entry-related questions for you:

- What is the journal entry for receiving ₹10,000 as advance payment from a customer?

- How would you record the payment of ₹7,000 for advertising expenses in cash?

- What is the journal entry for purchasing a vehicle worth ₹5,00,000 by taking a loan?

- How would you record the sale of an old machine worth ₹50,000 for cash?

- What is the journal entry for receiving ₹20,000 as a refund from a supplier?

- How would you record the payment of ₹12,000 as insurance premium by cheque?

- What is the journal entry for writing off ₹4,000 as discount allowed to a debtor?

- How would you record the purchase of stationery worth ₹3,000 in cash?

- What is the journal entry for transferring ₹1,00,000 from the business account to the owner’s personal account?

- How would you record the donation of ₹15,000 given to a charity in cash?

1. Receiving ₹10,000 as advance payment from a customer:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Cash/Bank A/c | 10,000 | |

| Advance from Customer A/c | 10,000 |

Explanation:

Cash/Bank is received, so the Cash/Bank Account is debited. The advance is a liability, so the Advance from Customer Account is credited.

2. Payment of ₹7,000 for advertising expenses in cash:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Advertising Expense A/c | 7,000 | |

| Cash A/c | 7,000 |

Explanation:

Advertising is an expense, so the Advertising Expense Account is debited. Cash is paid, so the Cash Account is credited.

3. Purchasing a vehicle worth ₹5,00,000 by taking a loan:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Vehicle A/c | 5,00,000 | |

| Loan A/c | 5,00,000 |

Explanation:

The vehicle is an asset, so the Vehicle Account is debited. The loan is a liability, so the Loan Account is credited.

4. Sale of an old machine worth ₹50,000 for cash:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Cash A/c | 50,000 | |

| Machine A/c | 50,000 |

Explanation:

Cash is received, so the Cash Account is debited. The machine is an asset, so the Machine Account is credited.

5. Receiving ₹20,000 as a refund from a supplier:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Cash/Bank A/c | 20,000 | |

| Supplier A/c | 20,000 |

Explanation:

Cash/Bank is received, so the Cash/Bank Account is debited. The supplier’s balance is reduced, so the Supplier Account is credited.

6. Payment of ₹12,000 as insurance premium by cheque:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Insurance Premium A/c | 12,000 | |

| Bank A/c | 12,000 |

Explanation:

Insurance is an expense, so the Insurance Premium Account is debited. Payment is made by cheque, so the Bank Account is credited.

7. Writing off ₹4,000 as discount allowed to a debtor:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Discount Allowed A/c | 4,000 | |

| Debtor A/c | 4,000 |

Explanation:

Discount allowed is an expense, so the Discount Allowed Account is debited. The debtor’s balance is reduced, so the Debtor Account is credited.

8. Purchase of stationery worth ₹3,000 in cash:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Stationery A/c | 3,000 | |

| Cash A/c | 3,000 |

Explanation:

Stationery is an expense, so the Stationery Account is debited. Cash is paid, so the Cash Account is credited.

9. Transferring ₹1,00,000 from the business account to the owner’s personal account:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Drawings A/c | 1,00,000 | |

| Bank A/c | 1,00,000 |

Explanation:

The amount withdrawn by the owner is recorded in the Drawings Account (debited). The bank balance is reduced, so the Bank Account is credited.

10. Donation of ₹15,000 given to a charity in cash:

| Account | Debit (₹) | Credit (₹) |

|---|---|---|

| Donation A/c | 15,000 | |

| Cash A/c | 15,000 |

Explanation:

Donation is an expense, so the Donation Account is debited. Cash is paid, so the Cash Account is credited.